Travel With Us

"Life is either a daring adventure or nothing at all."

10 Simple Techniques For What States Do I Need To Be Licensed In To Sell Mortgages

The Ginnie Mae CUSIP aggregation program started in March 2019 and was completed in July 2019 and the Desk combined around 8,000 individual CUSIPs into about 8 aggregated ones. The aggregation process was created to decrease administrative expenses and operational intricacies connected with the Federal Reserve's company MBS portfolio utilizing a straightforward and rules-based technique that is consistent with market.

functioning objectives and standard market practices. Other The New york city Fed releases in-depth data on all settled SOMA agency MBS holdings on its on a weekly basis. In addition, Fannie Mae, Freddie Mac, and Ginnie Mae provide info about aggregated CUSIPs, consisting of the underlying company MBS, on their public sites. Yes. Details about private Fannie Mae, Freddie Mac, and Ginnie Mae company MBS CUSIPs underlying the Federal Reserve's aggregated CUSIPs will remain readily available on these organizations' public sites.

's freshly imposed restriction on repooling of reperforming forborne loans yet again punishes servicers serving as important service suppliers in the continuing efforts to safeguard debtors dealing with financial hardship due to COVID-19. Let me count some of the ways Ginnie Mae servicers are bearing the force of debtor forbearance under the CARES Act: no maintenance cost earnings throughout forbearance of as much as a year( and potentially longer need to Congress decide its required); no remedy for advance requirements for the period of such forbearance; no revision of the structural obstacles to private funding to money advances; and no compensation for the expense of funds for advances. In issuing APM-20-07 on June 29, 2020, Ginnie Mae decided to further secure investors from the prospective enhanced http://www.rfdtv.com/story/43143561/wesley-financial-group-responds-to-legitimacy-accusations prepayment danger arising from early swimming pool buyouts of forborne loans. This security, however, comes at the expenditure of servicers. By restricting servicers from depending on long-standing, legitimate company activity early pool buyouts coupled with the repooling of reperforming loans Ginnie Mae has actually elected to deem a routine activity as inappropriate since it is unneeded and, gosh, may produce an earnings. This responsibility lasts until the defaulted loan is bought out.

loan secured by the mortgaged property, the profits of which are utilized to bring the loan present. By utilizing a junior lien, the loan does not require to be modified. Presently, a servicer might achieve a" stand alone partial claim" or a" home mortgage healing advance" without repurchasing the overdue loan from the pool, but servicers consistently combine the allowable early buyout of a delinquent loan, a reinstatement through a" stand alone partial claim" or" home loan recovery advance, "and a repooling of the reperforming loan into timeshare presentation las vegas freshly released securities. First, the customer under a reperforming loan should have made prompt payments for the 6 months right away preceding the month in which the associated mortgage-backed securities are issued.

Second, the issue date of the mortgage-backed securities need to be at least 210 days from the last date the loan was delinquent." Reperforming Loans "are not restricted to loans that are restored through a" stand alone partial claim" or "home loan recovery advance." The term is broadly specified to be a loan that is not more than thirty days delinquent, previously was purchased out of a Ginnie Mae swimming pool, and has the exact same rate and terms as the originally pooled loans. The APM just hints at the factor behind Ginnie Mae's change in position, specifying that "Ginnie Mae seeks to ensure that transactional activity associated with these alternatives does not hinder market self-confidence in Ginnie Mae securities. "It highlights that FHA's "Stand Alone Partial Claim" and USDA's "Home mortgage Healing Advance" do not need pool repurchases unless the terms of.

What Are The Percentages Next To Mortgages - The Facts

the loan need adjustment. Merely put, Ginnie Mae is depriving servicers of an enduring, legitimate, optional service strategy under the Ginnie Mae program obviously since this discretionary activity is not needed to make it possible for a servicer to stop maintenance advances in respect of forbearance. Generating a revenue from repooling reperforming loans somehow is seen as a dubious activity. In seclusion, insulating investors in Ginnie Mae securities from enhanced prepayment danger connecting to forbearance definitely is a worthy public policy goal. When compared to the costs, expenses and lost profits servicers are bearing in regard of forbearance, one has to wonder whether Ginnie Mae is relatively balancing the interests of servicers and financiers.

While Ginnie Mae may have the authority to revise the Mortgage-Backed Securities Guide from time to time, servicers have a right to reasonably count on the basic construct of the program without material adverse changes not grounded in law or abuse. Servicers develop, acquire and finance their Ginnie Mae MSRs based on this reasonable expectation. When you want to have fun in the sun right in.

your yard, a pool of your own might be paradise. A pool features a hefty cost tag, however, so be prepared to spend for it with time. While you have a couple of different options, among the most basic is to finance a new pool with a new home mortgage. First, call the loan provider with which you have your current home mortgage to ask about a brand-new home mortgage.

Typically your present loan provider will be excited to keep your financing, perhaps providing attractive interest and terms. mortgages what will that house cost. Keep in mind the terms provided by your existing lender. Approach two or 3 other lenders to ask about a brand-new home mortgage. With a new lender, you will require to reveal proof of identity and earnings, service warranty deed and homeowner's insurance coverage. The brand-new lender will examine your credit and.

inspect the worth of your house during a prequalification procedure. After validating your details and evaluating your credit reliability, the lending institution might extend you prequalification status.

The 10-Second Trick For Which Australian Banks Lend To Expats For Mortgages

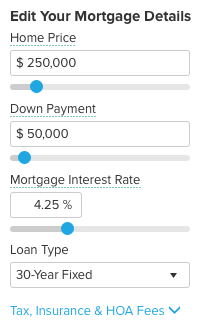

In addition, all loan providers, by federal law, need to follow the same rules when computing the APR to ensure precision and consistency. One point is equal to one percent of the overall principal amount of your home loan. For instance, if your mortgage quantity is going to be $125,000, then one point would equal $1,250 (or 1% of the quantity financed).

Lenders frequently charge points to cover loan closing costsand the points are usually gathered at the loan closing and may be paid by the debtor (property buyer) or home seller, or may be divided in between the purchaser and seller. This might depend upon your local and state policies in addition to requirements by your loan provider.

Make sure to ask if your mortgage contains a pre-payment charge. A pre-payment charge suggests you can be charged a cost if you settle your home loan early (i. e (how many mortgages can one person have)., settle the loan prior to the loan term expires). When you look for a home mortgage, your loan provider will likely use a standard type called a Uniform Residential Home Loan Application, Type Number 1003.

It is very important to provide accurate details on this form. The form includes your personal information, the purpose of the loan, your income and possessions and other details required during the certification process. After you give the lender six pieces of info your name, your earnings, your social security number to acquire a credit report, the residential or commercial property address, an estimate of the worth of the home, and the size of the loan you desire your lender needs to provide or send you a timeshare lawyers near me Loan Estimate within 3 days.

e., loan type, interest rate, estimated month-to-month home loan payments) you talked about with your lender. Thoroughly evaluate the price quote to be sure the terms meet your expectations. If anything appears different, ask your lender to describe why and to make any needed corrections. Lenders are required to offer you with a composed disclosure of all closing conditions 3 organization days before your scheduled closing date.

e, closing costs, loan amount, rates of interest, regular monthly mortgage payment, estimated taxes and insurance outside of escrow). If there are considerable modifications, another three-day disclosure period may be required.

The smart Trick of When Did 30 Year Mortgages Start That Nobody is Talking About

Deciding to end up being a house owner can be demanding for many newbie homebuyers. The looming concerns of price, where to purchase, and job security are all legitimate concerns that warrant serious factor to consider. The reality is that there's never ever a correct time or the ideal scenarios to begin this journey, but eventually, you wish to deal with house-hunting and the mortgage process as you would other significant life occasions.

Here are 5 crucial aspects every newbie homebuyer must think about when getting a mortgage. In a recent S&P/ Case-Shiller report, house rates rose 5. 2 percent. Even with a steady labor market that supports the price increase, house rates continue to climb faster than inflation firing up competitors for less offered houses.

Given, when inventory is low, it does end up being a sellers' market making it harder for buyers to compete, however working with a skilled-lender who can help facilitate the borrower through the process is necessary to getting approval. When purchasing a home, utilizing a team of professionals is a major component that might figure out the success or demise of your mortgage experience.

Bond recommends that when requesting a mortgage, make sure that your taxes are filed and organized. Gather your last month of paystubs and make sure you can easily access the last two months of your bank accounts. You ought to likewise obtain a letter of employment from human resources, and inspect your credit history to identify if there are any disparities.

Comprehending your numbers before home searching might conserve you from ending up being "house bad." Not paying your regular monthly credit card payment simply to live Check over here extravagantly isn't an accountable buyer's relocation. It's fairly difficult to get approval for a mortgage without a good credit rating. According to Bond, lenders consider just how much liquidity you have, how much debt you owe, your monthly earnings, and your credit rating when figuring out how much you can borrow and at what rate of interest.

A lot of banks need a minimum of 10 percent down; however, Bond recommends putting down a minimum of 20 percent to prevent paying private home mortgage insurance coverage. Personal home mortgage insurance coverage is default insurance coverage payable to a lending institution, and it can include a couple of hundred dollars to your month-to-month mortgage. Furthermore, repeating payments such as home loans, credit card payments, automobile loans, and child support, are used to determine your debt to income ratio (DTI).

Little Known Facts About How Did Subprime Mortgages Contributed To The Financial Crisis.

If you make $18,000 a month, your DTI would be 33 percent which falls within the variety where a bank would provide. The pitfall of not having a credit rating is one barrier that could halt or delay the application procedure. According to Miller, just utilizing a debit card can help you begin to develop a credit report.

The lending institution evaluates your work history, job stability, and down payment when figuring out whether you have the capability to repay. "If you've been on your first task for a month, you might want to offer yourself a little time to build a cost savings prior to leaping right into a mortgage," says Miller.

Do your research to find a mortgage loan officer that understands your family objectives and goals; somebody who can be a resource throughout the entire mortgage process. Consumer Affairs is a great location to start; the publication offers thousands of evaluations for dozens of different financing companies. Determining your debt-to-income ratio and comprehending how much of a monthly home loan payment you can pay for will keep you from overextending yourself and becoming "home poor.".

Lenders do not offer mortgages quickly. To get one, you'll need: Credit scores vary from 300 to 850, and a rating of 670 or above is thought about excellent. You may receive a home loan with a lower credit history, however if you do, you most likely won't snag a beneficial rate on your home mortgage.

You can do so by paying inbound bills on time https://ameblo.jp/josueeoqa524/entry-12657927821.html and paying off a chunk of your existing debt. Your debt-to-income ratio, meanwhile, measures the amount of money you owe every month on existing financial obligations relative to your regular monthly profits. If you owe excessive, mortgage lending institutions will be less likely to loan you cash, so preferably, you'll desire a debt-to-income ratio of 36% or lower.

The 9-Second Trick For How Does The Trump Tax Plan Affect Housing Mortgages

The IRC specifies "principally protected" as either having "considerably all of the earnings of the commitment - what kind of mortgages do i need to buy rental properties?. what do i do to check in on reverse mortgages. utilized to acquire or to improve or secure an interest in real estate that, at the origination date, is the only security for the responsibility" or having a reasonable market price of the interest that protects the obligation be at least 80% of the adjusted problem price (generally the quantity that is loaned to the mortgagor) or be at least that amount when added to the myrtle beach timeshare rentals REMIC - how to compare mortgages excel with pmi and taxes - the big short who took out mortgages.

Which Of These Statements Are Not True About Mortgages for Dummies

There are exceptions, however. If you're considering a reverse home loan, shop around. Choose which kind of reverse home mortgage might be best for you. That might depend on what you wish to make with the cash. Compare the choices, terms, and fees from different lenders. Find out as much as you can about reverse home mortgages before you speak with a counselor or lending institution.

Here are some things to consider: If so, discover if you get approved for any low-priced single function loans in your location. Staff at your local Area Firm on Aging may learn about the programs in your location. Discover the nearest firm on aging at eldercare. gov, or call 1-800-677-1116.

You may be able to obtain more cash with a proprietary reverse home mortgage. However the more you obtain, the greater the fees you'll pay. You likewise may think about a HECM loan. A HECM therapist or a lender can help you compare these kinds of loans side by side, to see what you'll get and what it costs.

While the home loan insurance premium is usually the same from lender to loan provider, the majority of loan expenses including origination charges, interest rates, closing expenses, and servicing fees differ among loan providers (what does ltv mean in mortgages). Ask a therapist or lender to describe the Overall Yearly Loan Cost (TALC) rates: they reveal the predicted yearly average expense of a reverse home loan, including all the itemized costs.

The 25-Second Trick For How Many Types Of Reverse Mortgages Are There

Is a reverse home mortgage right for you? Just you can decide what works for your situation. A therapist from an independent government-approved real estate therapy company can help. However a salesperson isn't most likely to be the very best guide for what works for you. This is specifically real if he or she imitates a reverse home loan is a solution for all your problems, presses you to get a loan, or has ideas on how you can invest the cash from a reverse mortgage.

If you decide you require house improvements, and you think a reverse home loan is the way to pay for them, look around prior to choosing a specific seller. Your home enhancement costs include not just the rate of the work being done but likewise the costs and charges you'll pay to get the reverse home mortgage.

Resist that pressure. If you purchase those kinds of monetary items, you could lose the cash you obtain from your reverse mortgage. You don't need to buy any financial products, services or investment to get a reverse home loan. In reality, in some scenarios, it's prohibited to require you to purchase other items to get a reverse home mortgage.

Stop and contact a counselor or somebody you trust prior to you sign anything. A reverse home loan can be made complex, and isn't something to rush into. The bottom line: If you don't understand the expense or features of a reverse mortgage, leave. If you feel pressure or seriousness to finish the offer leave (what are the interest rates on reverse mortgages).

What Does How To Calculate Extra Principal Payments On Mortgages Mean?

With many reverse home mortgages, you have at least 3 organization days after near cancel the deal for any reason, without charge. This is known as your right of "rescission." To cancel, you must alert the lending institution in composing. Send your letter by licensed mail, and request a return receipt.

Keep copies of your correspondence and any enclosures. After you cancel, the lender has 20 days to return any money you've spent for the funding. If you believe a fraud, or that somebody associated with the transaction might be breaking the law, let the therapist, loan provider, or loan servicer know.

Whether a reverse home mortgage is right for you is a big concern. Think about all your options. You may get approved for less pricey options. The following organizations have more information: 1-800-CALL-FHA (1-800-225-5342) 1-855- 411-CFPB (1-855-411-2372) 1-800-209-8085.

Possibilities are, you have actually seen commercials boasting the advantages of a reverse mortgage: "Let your house pay you a month-to-month dream retirement income!" Sounds wonderful, right? These claims make a reverse mortgage sound nearly too good to be true for senior property owners. However are they? Let's take a closer look. A reverse mortgage is a type of loan that uses your home equity to supply the funds for the loan itself.

3 Simple Techniques For What Credit Score Model Is Used timeshare in florida For Mortgages

It's generally an opportunity for retired people to take advantage of the equity they've developed over numerous years of paying their home mortgage and turn it into a loan on their own. A reverse home loan works like a regular mortgage in that you have to Click here for more info apply and get authorized for it by a lending institution.

But with a reverse home mortgage, you do not pay on your house's principal like you would with a routine mortgageyou take payments from the equity you've constructed (how are adjustable rate mortgages calculated). You see, the bank is lending you back the cash you have actually currently paid on your house but charging you interest at the exact same time.

Appears simple enough, right? However here comes the cringeworthy truth: If you die before you've sold your home, those you leave are stuck with two alternatives. They can either settle the full reverse home loan and all the interest that's piled up throughout the years, or surrender your house to the bank.

Like other kinds of home loans, there are different kinds of reverse mortgages. While they all essentially work the exact same way, there are three primary ones to learn about: The most common reverse home mortgage is the Home Equity Conversion Home Loan (HECM). HECMs were developed in 1988 to assist older Americans make ends fulfill by permitting them to take advantage of the equity of their homes without needing to vacate.

The Main Principles Of What Types Of Mortgages Are There

Some folks will utilize it to spend for bills, vacations, home restorations or perhaps to settle the staying quantity on their routine mortgagewhich is nuts! And the consequences can be huge. HECM loans are continued a tight leash by the Federal Real Estate Administration (FHA.) They don't want you to default on your home mortgage, so due to the fact that of that, you will not receive a reverse mortgage if your home deserves more than a particular amount.1 And if you do get approved for an HECM, you'll pay a significant home loan insurance coverage premium that secures the lending institution (not you) against any losses.

They're offered up from privately owned or run business. And because they're not controlled or insured by the government, they can draw house owners in with pledges of higher loan amountsbut with the catch of much greater rate of interest than those federally insured reverse home mortgages. They'll even provide reverse home loans that allow homeowners to borrow more of their equity or consist of homes that exceed the federal maximum quantity.

A single-purpose reverse home loan is provided by federal government agencies at the state and regional level, and by https://www.evernote.com/shard/s364/sh/d23cab0a-b4f5-d739-9b12-9c81d5b2387a/41d0329b10aedfe615dbe45a0253d3eb nonprofit groups too. It's a type of reverse home loan that puts guidelines and restrictions on how you can use the money from the loan. (So you can't spend it on an elegant getaway!) Generally, single-purpose reverse mortgages can only be utilized to make property tax payments or pay for house repair work.

Not known Details About What Are The Current Interest Rates For Mortgages

Whether you're currently sure an FHA loan is best for you or you're still trying to figure out just what the FHA is, we've broken all of it down. No need to learn the FHA handbook; discover responses to all your FHA Frequently asked questions right here. Affected economically by the pandemic? Click or tapNerdWallet's coronavirus resources page tracks the most recent developments, including information on loan and payment relief, methods to cope and how to finest handle your individual finances.

Under arrangements of the CARES Act, you might be qualified for home loan forbearance, short-term relief in which the lender enables you to make lower regular monthly payments, or no payments at all, for a defined time. See what kinds of home mortgage relief programs are offered to house owners who are worried about making their house payments due to the coronavirus outbreak.

With a minimum 3. 5% deposit for borrowers with a credit history of 580 or higher, FHA loans are popular amongst first-time house buyers who have little savings or credit obstacles. The FHA insures mortgages released by lenders, like banks, credit unions and nonbanks. That insurance coverage safeguards lenders in case of default, which is why FHA loan providers want to provide favorable terms to borrowers who may not otherwise certify for a mortgage." Only an FHA-approved lender can issue an FHA-insured loan." An FHA home mortgage can be utilized to purchase or re-finance single-family homes, 2- to four-unit multifamily houses, condominiums and particular produced and mobile houses.

The Federal Real estate Administration much better called the FHA has belonged to the U.S. Department of Real Estate and Urban Advancement since 1965. However the FHA in fact started more than thirty years before that, as a component of the New Deal. In addition to a stock market crash and the Dust Bowl drought, the Great Anxiety saw a real estate market bubble burst.

The FHA was developed as part of the National Real Estate Act of 1934 to stem the tide of foreclosures and help make homeownership more budget-friendly. It established the 20% down payment as a brand-new norm http://www.rfdtv.com/story/43143561/wesley-financial-group-responds-to-legitimacy-accusations by guaranteeing home loans for approximately 80% of a home's worth previously, homeowners had actually been limited to borrowing 50% -60%.

It's simpler to certify for an FHA loan than for a conventional loan, which is a home mortgage that isn't guaranteed or guaranteed by the federal government. FHA loans allow for lower credit history than conventional loans and, in many cases, lower month-to-month home loan insurance coverage payments. FHA guidelines are more liberal concerning gifts of down payment cash from household, companies or charitable companies.

Find Out How Many Mortgages Are On A Property Fundamentals Explained

The FHA uses a variety of loan choices, from relatively standard purchase loans to items designed to satisfy extremely particular requirements. Here's an overview of FHA loans frequently used to buy a house: No matter which kind of FHA loan you're looking for, there will be limits on the home mortgage quantity. These limits differ by county.

The ceiling for FHA loans on single-family homes in affordable counties is $356,362. An example is Lucas County, Ohio, where Toledo lies. The upper limit for FHA loans in the highest-cost counties is $822,375 San Francisco County, California, for example. Some counties have housing prices that fall somewhere in between, so the FHA loan limits are in the middle, too.

You can visit HUD's website to discover the FHA loan limitation in any county. You'll require to satisfy a variety of requirements to receive an FHA loan. It's important to keep in mind that these are the FHA's minimum requirements and lenders might have extra terms. To make sure you get the best FHA home loan rate and loan terms, shop more than one FHA-approved loan provider and compare deals." It is necessary to note that lenders might have extra terms." The minimum credit report for an FHA loan is 500.

Once again, these are FHA standards individual lending institutions can choose to need a greater minimum credit report. If you've got a credit report of 580 or higher, your FHA down payment can be as low as 3 - what is a non recourse state for mortgages. 5%. A credit report that's in between 500 and 579 ways you'll need to pay 10% of the purchase rate.

You can utilize present money for your FHA down payment, so long as the donor offers a letter with their contact info, their relationship to you, the amount of the present and a statement that no payment is anticipated. Nerd suggestion: Look into state and local deposit help programs for newbie homebuyers (normally defined as someone who has actually not owned a house within the previous 3 years).

The FHA needs a DTI of less than 50, indicating that your overall monthly debt payments can't be more than 50% of your pretax earnings. This includes financial obligations check here that you aren't actively paying (what kind of mortgages do i need to buy rental properties?). For trainee loans in deferment, your FHA loan underwriter will include 1% of the loan's overall as the monthly payment amount.

Top Guidelines Of What Happens To Bank Equity When The Value Of Mortgages Decreases

The FHA needs an appraisal that's different (and different from) a house examination. They desire to make sure the house is an excellent investment to put it simply, worth what you're paying for it and ensure that it satisfies standard security and livability requirements. For an FHA 203( k) loan, the home may go through 2 different appraisals: An "as is" appraisal that evaluates its current state, and an "after enhanced" appraisal estimating the value once the work is completed.FHA mortgage insurance coverage is developed into every loan. If you start with a down payment of less than 10 %, you'll continue to pay home loan insurance for the life of the loan. Those with 10% down payments will pay FHA home mortgage insurance coverage for 11 years. Obtaining an FHA loan will require personal and financial documents, consisting of however not restricted to: A valid Social Security number. citizenship, legal long-term residency or eligibility to work in the U.S.Bank declarations for, at a minimum, the last 30 days. You'll also require to supply documentation for any deposits made during that time( generally pay stubs ). Your loan provider may be able to automatically retrieve some needed paperwork, like credit reports, income tax return and work records. Even if your credit report and monthly spending plan leave you without other choices, be conscious that FHA loans include some compromises. Lower minimum credit rating than traditional loans. Down payments as low as 3. 5%. Debt-to-income ratios as high as 50% allowed. Disadvantages of FHA loans: FHA home loan insurance lasts the full term of the loan with a down payment of less than 10%. No jumbo loans: The loan amount can not surpass the adhering limit for the location. what kind of mortgages do i need to buy rental properties?. Even though the FHA sets standard requirements, FHA-approved lenders 'requirements might be different.FHA rates of interest and costs also vary by lending institution, so it is essential to comparison store. Getting a home loan preapproval from more than one lender can help you compare the total expense of the loan.

About

There are some mortgage loan options provided by the federal government. They will usually have particular eligibility requirements.: Federal Real estate Association (FHA) loans are developed to assist lower-income customers purchase with a lower deposit (as low as 3. 5% sometimes) or a credit rating as low as 500.: Department of Veterans Affairs (VA) loans are offered to veterans and might not require a deposit or personal home mortgage insurance coverage depending upon the lender.: U.S.

A nonconforming home loan does not adhere to the Federal National Home Mortgage Associated and Federal Home Mortgage Home mortgage Corporation purchasing standards. These loans will have higher rate of interest. A home loan may become noncomforming if it surpasses adhering loan limits or based on the customer's down payment, DTI, credit rating and documentation requirements.

For many of the country, a jumbo loan is needed for Look at more info loans of $510,400 or greater, although more pricey areas have a greater baseline of $765,600. Generally, the minimum down payment recommended is 20%. Some loan providers will need you to purchase private home mortgage insurance coverage (PMI) if you put down less than that.

It's best to save up a considerable quantity of money for a deposit before you begin the process of purchasing a home. On the other hand, you can get a house with as low as 5% deposit, you'll just deal with larger rate of interest and potentially a higher regular monthly payment. [Read: Why Do You Required a Down Payment, Anyway?] The optimum amount you can borrow for a mortgage will depend almost completely on your full financial picture. Such threat factors may include a greater debt-to-income ratio. These programs normally offer 30-year set rate loans and reduced down payments that house owners can fund or pay with grants, if available. While these can be advantageous for debtors who can't qualify for a traditional mortgage, they typically come with a type of mortgage insurance, which will contribute to the cost of your regular monthly housing payments.

It takes into account all the costs and charges you pay when you get the home loan (such as closing expenses) and spreads those out over the life of the loan so you can get a concept by means of an annualized rate of what you're in fact paying. By contrast, your stated rate of interest is the number used to determine your regular monthly payment.

What Type Of Interest Is Calculated On Home Mortgages Fundamentals Explained

Of the 2, the APR offers more of a broad view glance at what you'll pay. The federal government needs banks to list the APR to prevent concealed or unexpected charges. Looking at the APR can be useful when comparing 2 various loans, especially when one has a reasonably low rates of interest and higher closing expenses and the other has a higher rate of interest but low closing expenses.

The APR is typically higher than the mentioned rates of interest to take in account all the charges and expenses. Typically it's just a couple of portions of a percent higher, though you must give anything bigger than that a difficult review. When you're exploring 40-year home mortgage rates and 30-year home loan rates, those fees are spread out over a longer amount of time.

But for 20-year home mortgage rates, 15-year home loan rates and 10-year home mortgage rates, the difference between the APR and the rates of interest will likely be higher. Picture credit: iStock/DNY59The APR is an excellent tool for comparing 2 mortgages with different terms, however it's eventually crucial to think about all elements of your loan when deciding.

And there are other, non-financial elements also. Every mortgage lending institution does organization its own method. Some use an individual touch with each customer and others use the most innovative technology to make your loaning http://johnathankgyc468.yousher.com/the-main-principles-of-what-is-the-catch-with-reverse-mortgages experience simple. Do you choose a small, regional institution? An online lending institution? A national bank with a 100-year history and a recognized track record? There's no ideal answer to any of these concerns, but they are essential to think of however.

Before you sign your papers, it's a good idea to research your lending institution. Read reviews, the company website and any homebuying product the lender releases. It can help you get an idea of the company prior to you operate. The fact is no mortgage lender has a clear edge when it comes to home mortgage rates.

Why Do Banks Sell Mortgages To Fannie Mae Fundamentals Explained

It really depends on individual situations. This is why it's so essential to check out a range of lenders and see what they can provide you. Using tools, such as our rate comparison tool, can assist you compare home loan rates for your particular scenario and offer you a good idea of what rates you might get approved for.

When a newbie property buyer hears the word "home loan," they do not often think about it as a product. The idea they can contrast look for one seems unusual isn't loan credentials based upon the exact same requirements? The fact is that the rate and terms of a home mortgage are typically flexible and vary lending institution by lender (how do down payments work on mortgages).

Contrast shopping isn't odd, it's a necessity specifically prior to such a significant commitment. Contrast shopping for a mortgage isn't typical. According to the Consumer Financial Protection Bureau, only 30% of American customers look at more than one loan provider for a home loan. In the next 10 years alone, it's expected that Millennials are set to acquire 10 million new houses.

As you shop around for a mortgage, below are the bottom lines to bear in mind and the errors to prevent as you protect an affordable rate and appealing terms. Before you begin the process of window shopping, a little context will assist. There isn't a standard set of rules or deals among all home mortgage lenders.

Bottom line: You might discover a much better offer with one lender than with another. To start, you'll wish to discover a home mortgage lending institution that uses a good rates of interest. Altering rates have an intensifying impact gradually and even a slight boost like 0. 5 percent cost a substantial quantity of money over the life of a loan.

6 Simple Techniques For What Is The getting out of a timeshare Current Interest Rate For Va Mortgages

An adjustable-rate mortgage may increase at some time in the loan term and increase your month-to-month payment. Fixed-rate loans by contrast will not change. There are likewise other aspects that will affect your last choice beyond interest rate. Think about the following when contrast shopping lenders: Charges that have a link to your interest rate.